The next idea we would like to introduce is leverage or gearing. That is, making your money go further by borrowing additional cash from a bank or other lender. Now, for the sake of simplicity we have made a few assumptions here. Those are:

- No inflation

- Good credit

- A healthy 9% net rental return

- The cost of borrowing, paying interest and capital over say, 20 years, is 7%

- The cost of the property is $200,000 to buy and $300,000 to renovate

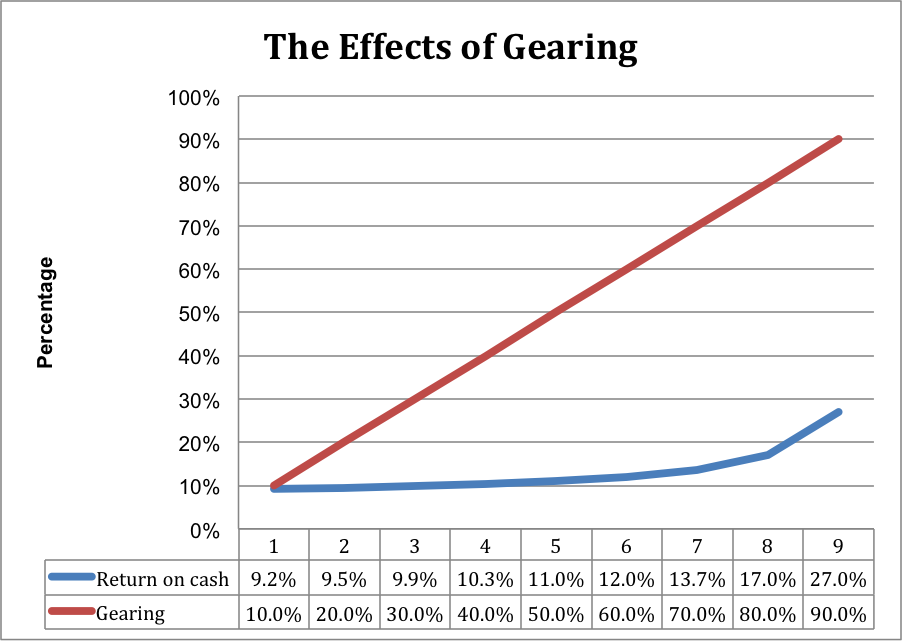

- We have examined the effect of borrowing from 10% to 90% of the total required. This assumes a Bank is willing to lend up to 90% and this may not be the case.

So what happens? The cash generated by the property in the form of rents in this illustration is generating 9% net. That is 9% after all costs, maintenance etc. This is quite a good investment property in terms of the return achieved. The cash contributed by the investor is at no cost, that does not mean cash is free just that sitting in the bank its not earning much. The cash from the bank, including repayments is costing 7%. This is less than the 9% that the property is generating so you will be making a modest additional income from the Bank’s money.

Now referring to the graph above. As leverage increases, that small additional 2% starts to improve your returns. At first its very small, then increases exponentially.

This is where you need to be very careful. There is a temptation to leverage to the maximum, returns are much better and all is good. However, do you remember property prices dropping recently? Ring any alarm bells? For a robust business model it is very unhealthy to over leverage. You may end up owning more than the property is worth and that’s not a great place to be.

Our own strategy is to leave 30 or 40% of our own cash in the property and mortgage the remainder. This frees cash for the next project but also protects our investment should property prices fluctuate. At 70% leverage we have improved a 9% return to a near 14% (13.67) which is very healthy given we can also add property inflation and general property improvements in to this plus increasing rentals.

So, in summary, it is important to remember that gearing will help you improve the return on your cash. Do not be tempted to overplay your hand in this respect. Be conservative.

In the next article we will look at how your equity position will change over time as you pay cash back in your mortgage and property prices increase with general inflation.

Interested in Learning More?

Our expert teams - from development, investment, real estate, and property management - have experienced it all and have the insight to help you along the way.

Find Out More